Cuts down time

Clariv cuts down the time teams spend tracking complaints, reviewing comments, or monitoring digital channels. You stay ahead of issues, respond faster, and protect your reputation without increasing headcount.

Financial customers judge your brand on every interaction and how you communicate online. Clariv brings all of this together so financial teams can stay ahead of issues and show up consistently where it matters.

Clariv gives financial institutions a secure, unified way to track client sentiment and improve online reputation while managing all social channels from a single, compliant workspace.

Measurable improvements in client trust, risk visibility, compliance oversight, and digital credibility without adding staff or managing fragmented systems.

Because it strengthens client trust, reduces risk, and keeps your brand consistent without adding complexity.

Clariv cuts down the time teams spend tracking complaints, reviewing comments, or monitoring digital channels. You stay ahead of issues, respond faster, and protect your reputation without increasing headcount.

Clariv helps financial marketing teams plan and schedule approved posts across social media platforms, while ensuring messaging stays brand-safe and compliant.

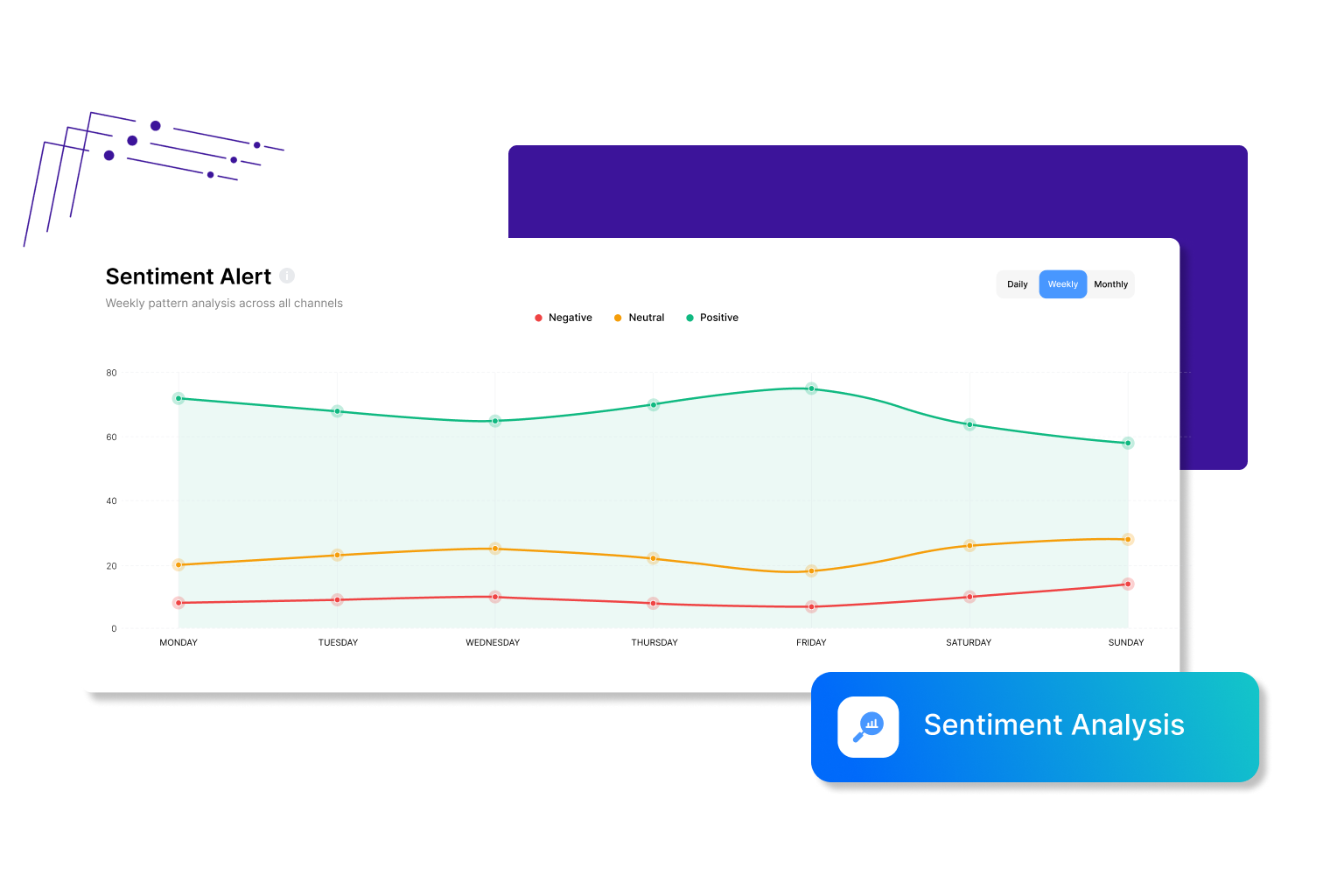

AI flags patterns that may lead to regulatory exposure or customer dissatisfaction, long before they become formal complaints.

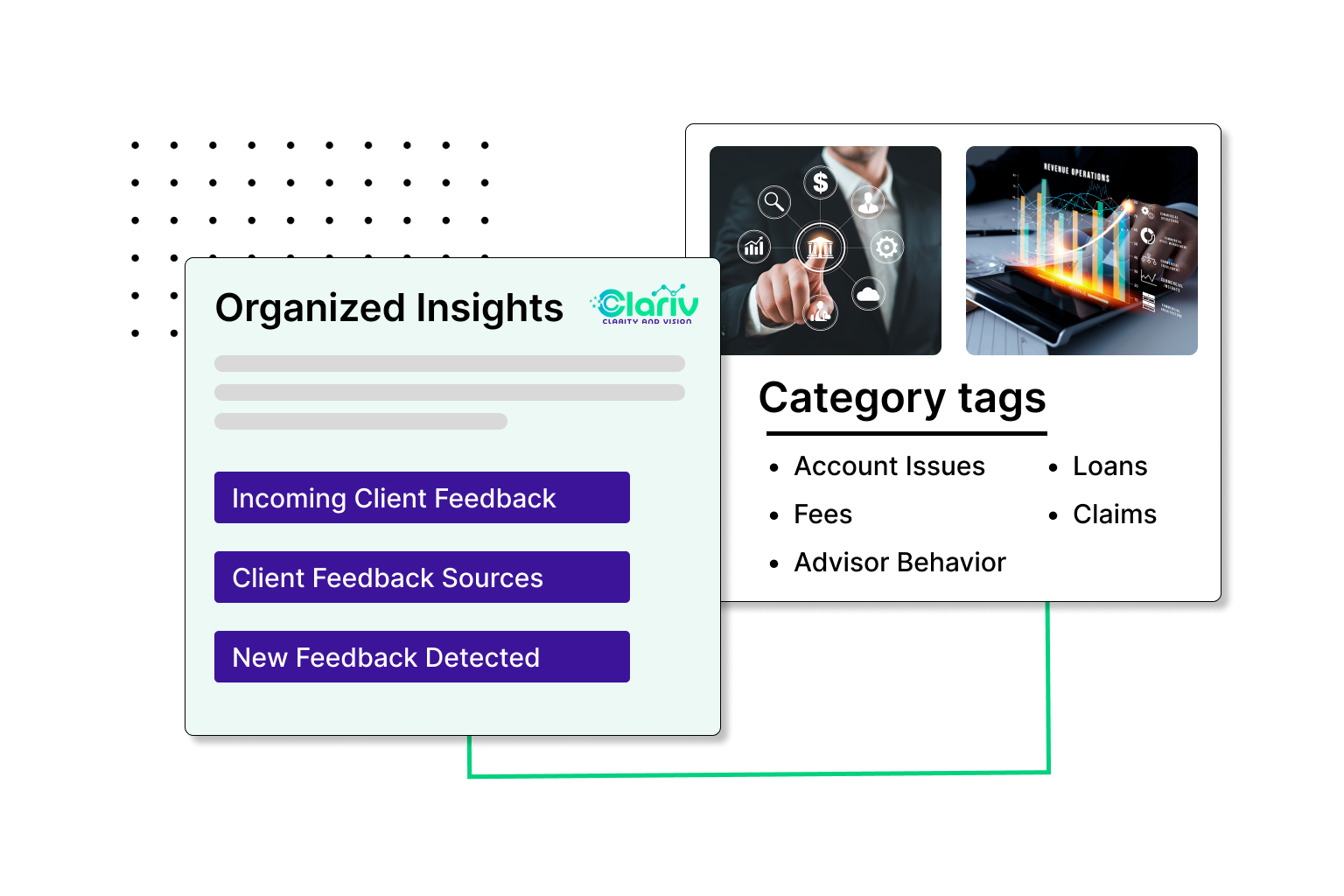

Clariv reveals the real drivers of trust, service quality, policy clarity, advisor interactions, wait times, and product issues so leaders can take targeted action with confidence.

Clariv helps financial brands stay proactive, compliant, and connected, giving teams more control with less effort.

Get notified immediately when negative sentiment spikes, repeated complaints appear, or sensitive conversations need review. It alerts by branch, advisor, product, or channel.

Automatically group reviews and complaints into financial categories like fees, loans, account issues, claims, advisor behavior, and service quality. Clear organization for easier follow-up and reporting.

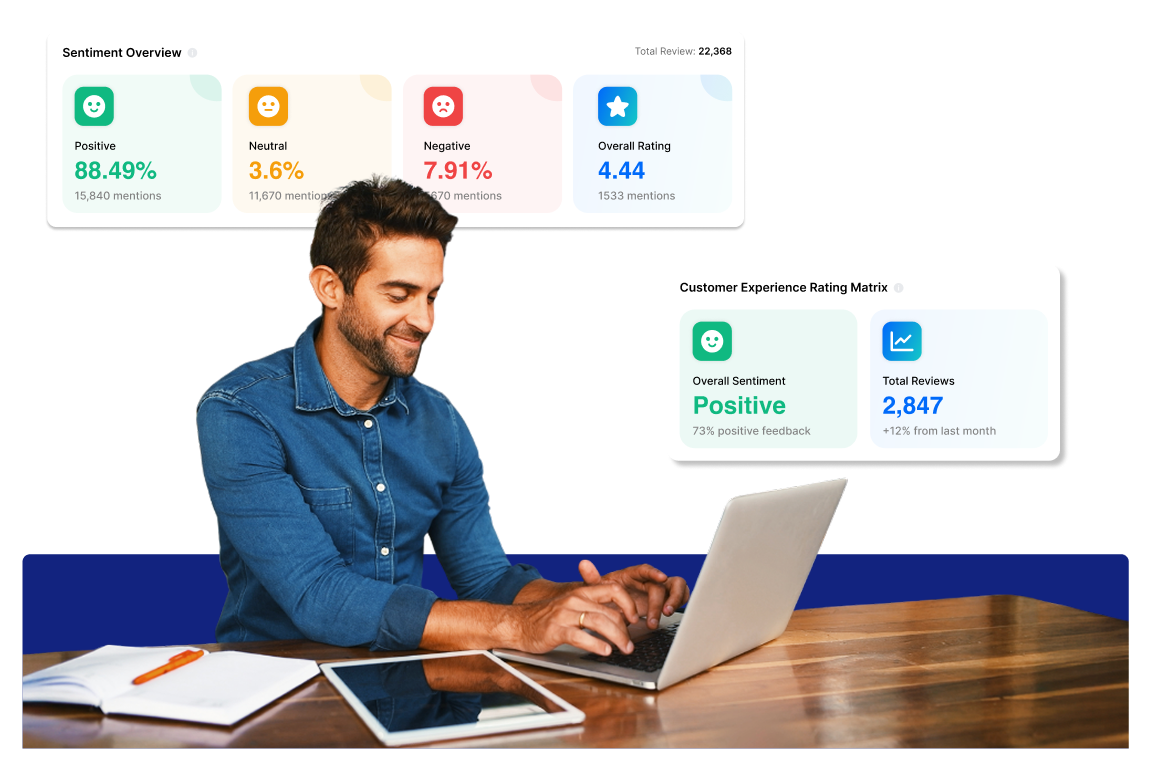

Live reporting shows sentiment trends, rating changes, advisor patterns, and service performance across locations with just one dashboard for leadership, regional managers, and branch teams.

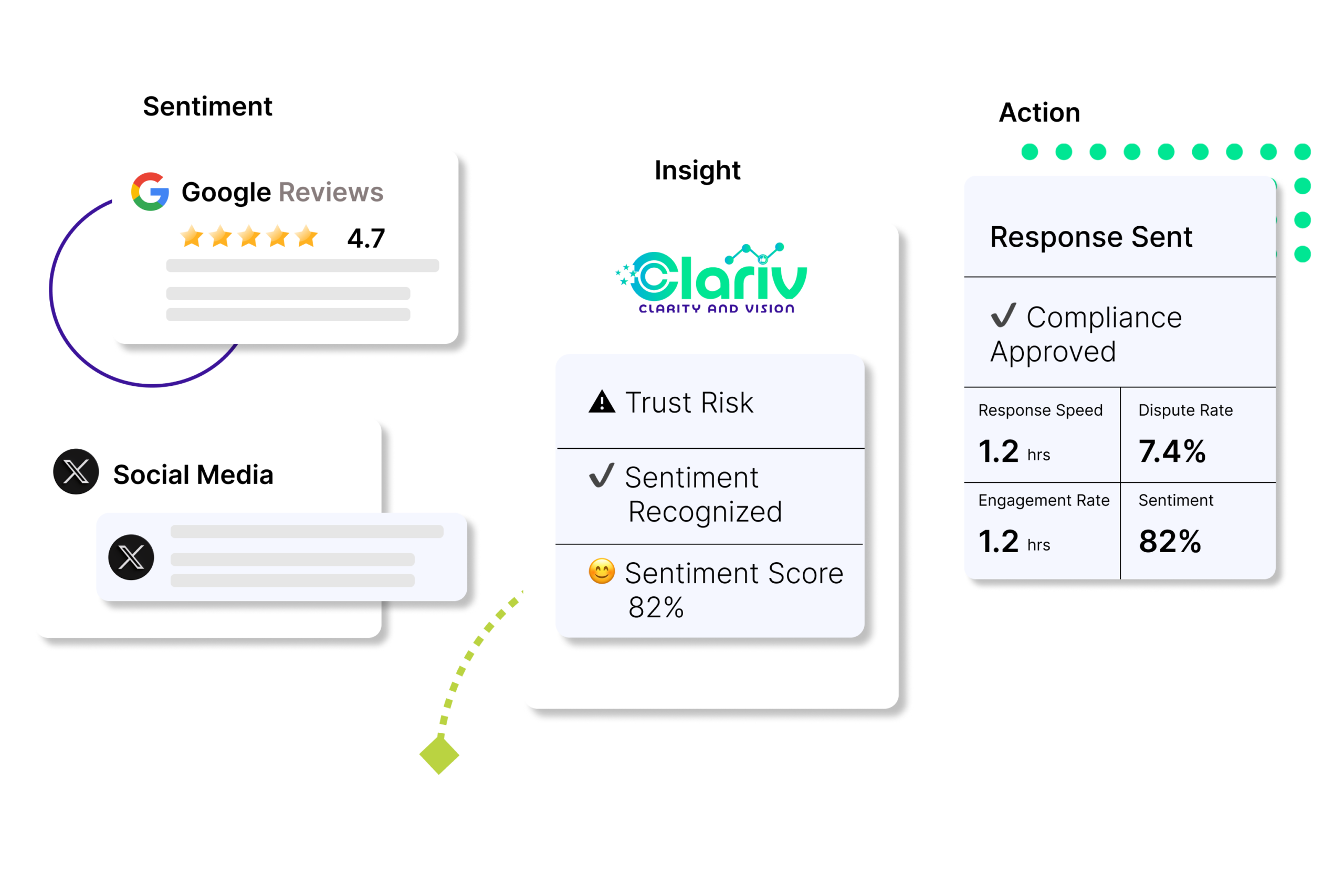

Clariv suggests compliant, on-brand responses across all platforms while keeping messaging consistent. Advisors, branch teams, and CX reps respond faster with fewer errors.

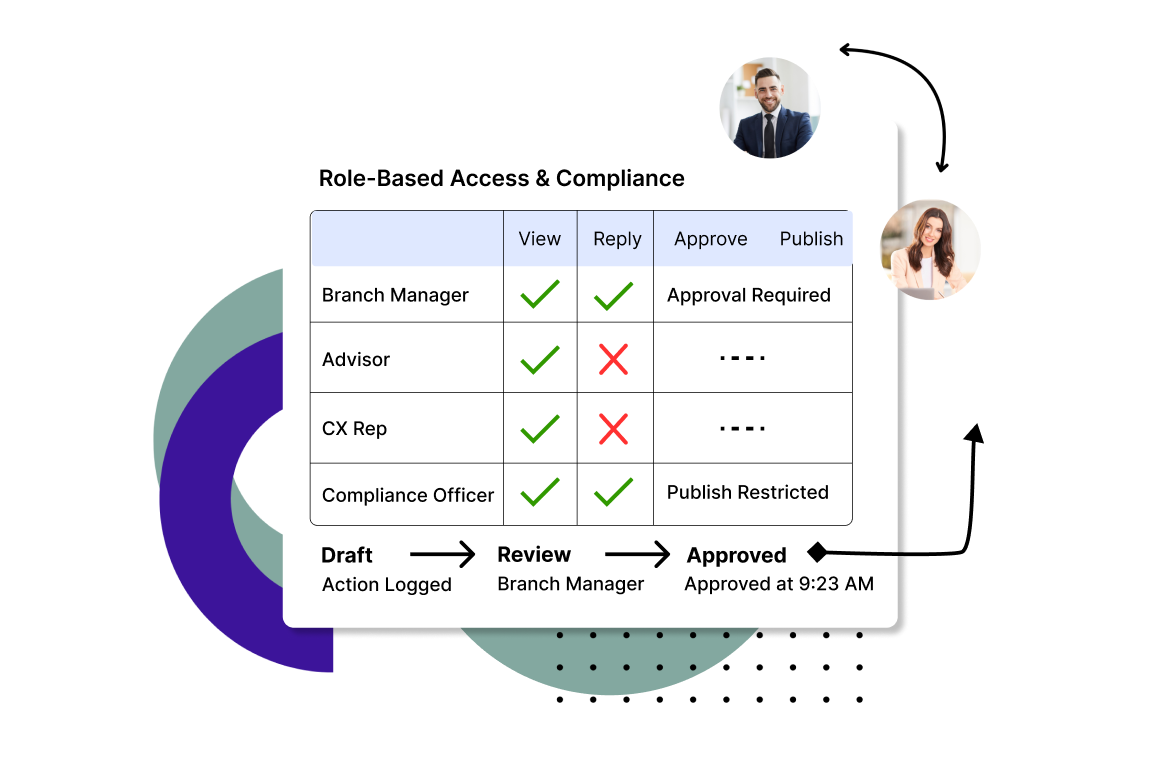

Give secure access to branch managers, advisors, CX reps, marketing, and compliance, each with the right permissions. Custom roles, approval flows, and audit trails built in.

Measure which financial content (educational posts, advisor updates, product announcements) performs best across platforms and take decisions accordingly to empower your social presence.

A no-stress, compliant setup that helps financial institutions understand client sentiment and maintain a consistent, trusted digital presence.

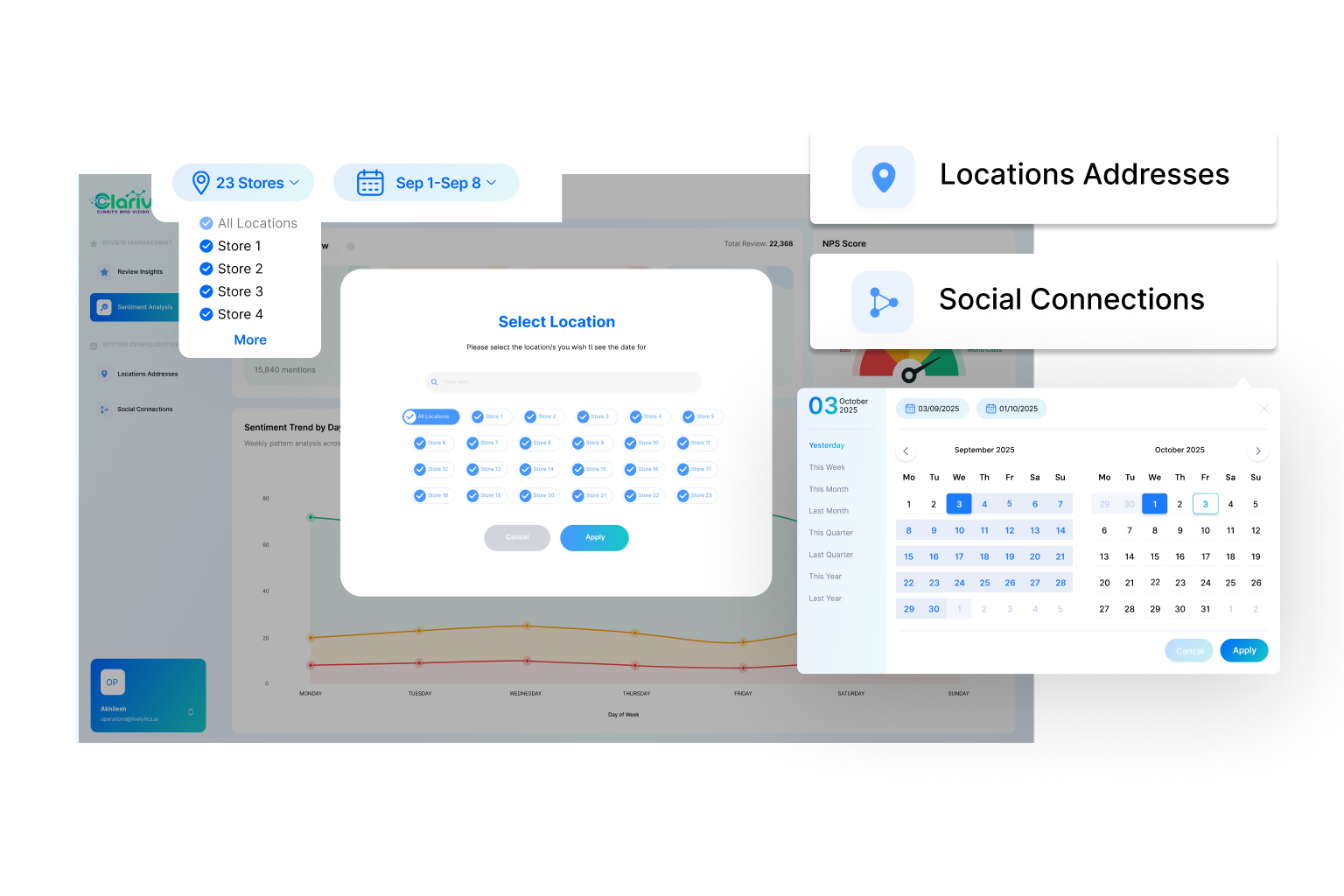

Integrate Clariv with Google, Yelp, App Store, CRM systems, contact centers, and all major social platforms. No IT complexity, no manual data pulls, everything flows securely into one system.

After the integration, AI reviews every client conversation, from branch feedback to digital comments, detecting emotions and tagging relevant queries, so you instantly see what impacts trust or risk.

All client feedback, reviews, complaints, DMs, comments, and survey responses appear in a unified inbox. You can monitor issues, respond faster, and ensure nothing important slips through during busy hours.

Based on the insights, Clariv will help you curate a visual calendar to plan, approve, and publish content across different social media platforms. Compliance teams can review posts before they go live, ensuring accuracy and regulatory safety.

Track what clients are saying about your business across different touchpoints. Sentiment trends + content analytics together help financial institutions understand what drives trust and long-term loyalty.

Clariv learns how your branches, advisors, and digital channels perform & suggests what to fix, which issues may become risks, when to post, how to respond, and where client trust is slipping, helping leaders act proactively.